FREE Webinar Details: How To Legally, Ethically, and Systematically Reduce Your Taxes To a Dollar.

(Yes, A Tax Plan That Works With High Taxable Income)

Here’s Just A Fraction Of What You’ll Discover with the Genius Tax Plan:

- As a Business Owner you have a world of tax-saving opportunities your CPA probably hasn't shared with you— because they are just not taking care of you as they should, or they just don’t do the hard work.

- Uncover how to systematically bring your tax bill down to a $1 (we have helped many clients literally write a check to the government for $1). We call this “Deduction Stacking”, and it works!

- GREAT NEWS: You won't need to dive into the overwhelming 55,000-page Tax Code to save big on taxes. It’s all laid out for you by following a framework to pocket thousands of dollars in tax savings every single year.

- Explore real-life examples showcasing our tax-saving strategies in action. As a business owner, you have opportunities unavailable to most. Watch as we devise “entity engineering” to specific client’s financials and illustrate the tax reduction in real time.

- Learn the right way to file for various tax deductions—the ones many get wrong and trigger IRS red flags.

- Watch as we detail the “4 bucket” asset protection model and show you the landmines with “danger assets” and provide the matrix of exactly how to title certain assets.

- …And this is only a small fraction of what you’ll learn from the webinar!

Protect your hard-earned cash:

Fact: Most People Are Overpaying Their Taxes

In this free webinar, you will gain insight into how our tax experts help our clients save hundreds of thousands of dollars each year using just a few of the strategies we use.

You will discover that there are numerous tax-saving opportunities that are frequently overlooked by most business owners, including yourself.

You will see that most accountants and CPAs fail to identify many tax deductions, leaving your money on the table for reasons that will be discussed in the webinar.

And you will see for yourself that it is possible for you to save even more on taxes and safeguard your wealth for your heirs.

Discover How To Legally Slash Your Taxes.

More Than Two Decade Of Hands-On Experience

This webinar is presented by Michael Liguori, a CPA and financial strategist with more than two decades of hands-on experience helping business owners like you get the maximum savings on taxes that you can legally keep.

Michael’s strategies are creative, yet conservative— and each is carefully designed and documented to provide you peace of mind!

In fact, we’re confident that after viewing this instructive and insightful webinar, you’ll agree he’s the go-to person for unlocking substantial tax savings.

Many of Michael’s clients consistently save several hundred thousand in taxes every single year.

Now, you have the exclusive opportunity to see the entire planning all laid out and see many of the tax strategies in action.

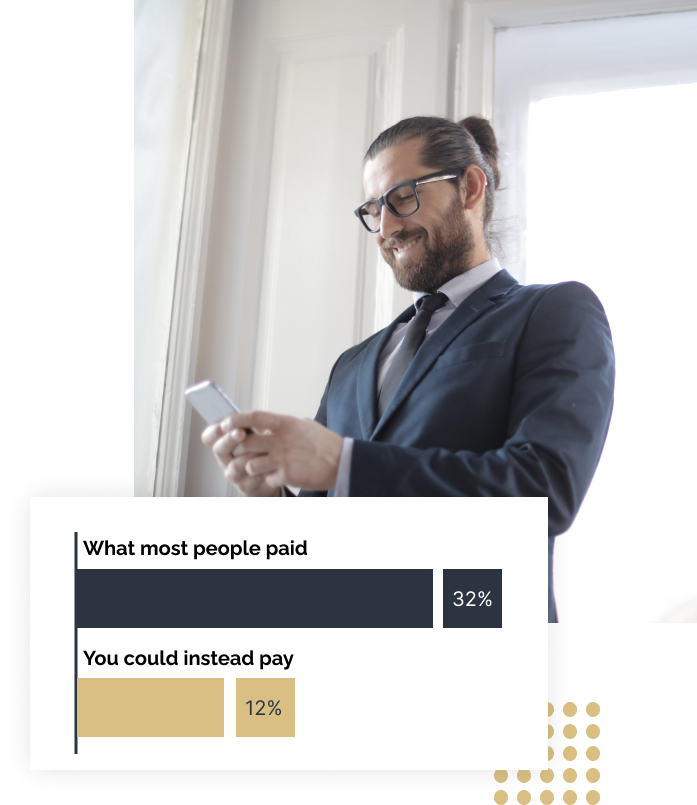

Legally Slash Your Taxes To Less Than 12%

100% FREE With No Strings Attached

We know there are some webinars out there that promise you the world, but only give you a tiny bit of information / half the picture. Then they try to pressure you into buying their expensive online course to unlock it all.

This is NOT one of them.

Every strategy in this webinar is clear and easy to follow. You’ll know exactly what to do, how to do it, and why. Plus, you’ll see real-life examples of people using these strategies successfully, so you’ll know exactly how to apply them.

We’re giving you these valuable insights, as a means of “putting our best foot forward” and demonstrating real value. We know from experience that if you’re a savvy business owner, you will just want it all done for you, providing you with massive savings, peace of mind, and certainty that you’ve audit-proofed your business as much as possible.

With that said, there is a question we want you to ask yourself:

Which Group Do YOU Want To Belong To?

Look, the fact is that 98% of people will procrastinate and hope that this area of their life just gets better. And it won’t change their lives.

It’s a harsh truth. People often want the result but hesitate to take the necessary steps. This is why so many business owners continue to overpay their taxes, despite having access to valuable tax-saving strategies and a solid tax plan (as we discuss in the webinar).

But there’s the 3% that act.

…The ones that truly benefit by learning and then implementing. These are the types of individuals that really do well with our program.

We hope you find yourself in the latter group.

Fill out your information below to sign up for this FREE webinar:

Still On The Fence? Consider This For A Moment...

Again, the webinar is 100% free. But not taking action could hit you hard in the wallet.

Really hard.

Because it could mean you would still be overpaying your taxes—potentially by thousands, tens of thousands, or even hundreds of thousands of dollars annually.

Consider this scenario:

- If your annual income is $300,000 over the next decade. Assuming an effective tax rate of 31%, you’ll fork out $930,000 in income tax.

- On the other, with a 10% tax bracket, which is completely possible and we’ll show you how, you pay $300,000 in income tax

That’s a difference of $630,000.

Now, ask yourself: who do you want that money to go to—you or the government?

The answer is obvious. So why not invest one hour and see for yourself…